Better health for you

Thanks to Medibank and Yancoal NSW.

Health insurance for residents

Step 1

Choose a hospital cover

Corporate Gold Health Cover

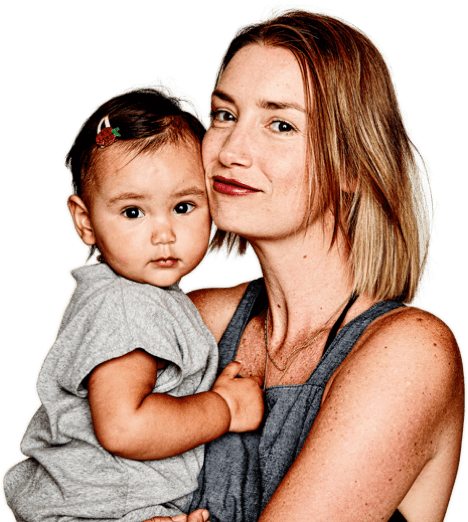

Corporate Health providing comprehensive Hospital cover, including Pregnancy and birth.

Hospital

$250 excess

- Pregnancy and birth

- Weight loss surgery

- Joint replacements

- Heart and vascular system

- Chemotherapy, radiotherapy and immunotherapy for cancer

And more...

The amount you pay before Medibank contributes to your hospital costs.

Corporate Silver Plus Health Cover Elite

A higher level of hospital cover that doesn't include Pregnancy and birth, designed for established families. Why pay for services you don’t need?

Hospital

$250 excess

- Weight loss surgery

- Joint replacements

- Heart and vascular system

- Chemotherapy, radiotherapy and immunotherapy for cancer

And more...

The amount you pay before Medibank contributes to your hospital costs.

Corporate Silver Plus Health Cover

Includes a broad range of services, such as Heart and vascular system admissions, to provide peace of mind.

Hospital

$250 excess

- Cataracts

- Dialysis for chronic kidney failure

- Pain management with device

- Heart and vascular system

- Lung and chest

And more...

The amount you pay before Medibank contributes to your hospital costs.

Corporate Silver Health Cover

Includes the Bronze and Silver hospital services - why pay for more than you need?

Hospital

$250 excess

- Heart and vascular system

- Lung and chest

- Joint reconstructions

- Chemotherapy, radiotherapy and immunotherapy for cancer

- Back, neck and spine

And more...

The amount you pay before Medibank contributes to your hospital costs.

Step 2

Choose an extras cover

Better Health 90

Includes a wide range of extras including major dental, orthodontics, physiotherapy, optical and remedial massage.

Extras

90% claimback

- Claim back 90% on Extras~

- General and Major Dental

- Optical

- Physio

- Podiatry

And more...

The amount you can claim back at Members’ Choice providers, up to annual limits.

Better Health 80

Includes a wide range of extras including major dental, orthodontics, physiotherapy, optical and remedial massage.

Extras

80% claimback

- Claim back 80% on Extras~

- General and Major Dental

- Optical

- Physio

- Podiatry

And more...

The amount you can claim back at Members’ Choice providers, up to annual limits.

Better Health 70

Includes a wide range of extras including major dental, orthodontics, physiotherapy, optical and remedial massage.

Extras

70% claimback

- Claim back 70% on Extras~

- General Dental

- Optical

- Physio

And more...

The amount you can claim back at Members’ Choice providers, up to annual limits.

Better Health 60

Includes a wide range of extras including major dental, orthodontics, physiotherapy, optical and remedial massage.

Extras

60% claimback

- Claim back 60% on Extras~

- General Dental

- Optical

- Physio

And more...

The amount you can claim back at Members’ Choice providers, up to annual limits.

The amount you pay before Medibank contributes to your hospital costs.

The amount you can claim back at Members’ Choice providers, up to annual limits. Fixed amounts apply at non-Members’ Choice providers, up to annual limits.

Waiting periods and annual limits may apply.

~ You'll receive a fixed percentage back on specified services at all recognised providers, up to annual limits.

Yancoal and MPL will provide health insurance to eligible employees. Where premiums are displayed on this site, they take into account any information that you have provided and selections that you have made relevant to your personal circumstances however, the premiums displayed do not take into account any discount that you may be entitled to as part of the Corporate Agreement in place between Yancoal and Medibank.

Corporate cover with Yancoal and Medibank

Covers that display “from $0.00” represent those covers that are subsidised by your employer, up to the agreed value and conditions. If you choose cover that exceeds this amount or is outside the conditions, you simply pay the portion that exceeds your employer’s contribution from your nominated account monthly.

Request a call back

Leave your details and a Medibank expert will be in touch to take you through your options. In providing your telephone number, you consent to Medibank contacting you about health insurance.

We'll have someone call you soon to help with any questions you have.

COVID-19 Health Assist - Expression of interest

Complete this form to express your interest in one of our programs. If you're eligible, a member of our team will call you within 2-3 business days.

What program are you interested in?

Sorry, only members with current Hospital cover are eligible to participate in these programs

Eligible Medibank members with Extras cover are able to access a range of telehealth services included on their cover - you can find out more here. Alternatively, if you would like to talk to one of our team about your cover, we're here on 132 331.

Your membership details

Please provide your details so we can know how to contact you.

Your contact details

By clicking Submit, I understand that Medibank or its subsidiaries may contact me to discuss my eligibility for the Covid-19 Heath Assist program(s), and will disclose my personal information within the Medibank Group of companies and to third party service providers. Please see Medibank’s privacy policy for further information about how Medibank will handle my personal information, and how to contact Medibank: https://www.medibank.com.au/privacy/

Thank you for expressing your interest in one of our COVID-19 Health Assist programs.

If you are eligible, one of our health professionals will call you in 2-3 business days to discuss your situation and help to enrol you in the relevant program.

There is no cost to participate, however some referred services may incur an out of pocket cost.